What are Escrow Accounts in a Mortgage?

What Are Escrow Accounts?

When it comes to obtaining a mortgage, you may have heard of the common term “escrow”. It goes without saying that escrow is crucial in the home buying process and should not be overlooked.

Once you have completed the contract and the seller has accepted your offer, either your real estate agent or mortgage lender will open escrow. To handle the property transaction, an escrow company is a third party responsible for protecting the buyer’s earnest money deposit and holding funds for taxes and insurance. These costs will be held until closing.

Working with escrow usually doesn’t end there, as there is a second type of escrow that is utilized for other fees involved with your mortgage. Here’s everything you need to know about escrow accounts before diving into the process.

Two Types of Escrow Accounts

Most people don’t learn about escrow accounts until they’re far down the path of getting their first mortgage. They are also surprised to find out that there are two types of escrow accounts:

The first is the use of a third party, commonly an escrow company, that holds the earnest money deposit for a home until all conditions of the contract are met. The reason why escrow holds these funds in an account is to ensure the financial safety of the parties involved. The escrow account acts as a safety net and contributes to a smooth mortgage transaction.

Unfortunately, there are plenty of scams associated with mortgages, such as wire fraud and identity theft. An escrow account helps avoid these issues and serves as the middleman for the transactions involved.

The second type is used for taxes and insurance for the life of the loan. This escrow account (sometimes called an impound account) is a fund managed by your mortgage company that acts as a safety net for future homeowner’s insurance premiums and property tax payments. The fund automatically pays your annual home insurance and semi-annual (twice a year) property tax payments, ensuring that they do not go unpaid.

Unpaid taxes and insurance can result in the home being foreclosed on, so lenders use escrow accounts as a way to protect both the borrower and their investment in the home.

In this article, we will be discussing the latter of the two types, which is primarily used for taxes and insurance.

How Does Escrow Work?

A common question that borrowers have after closing is “why am I still paying escrow as part of my monthly mortgage payment?”. Don’t worry, it’s probably not a mistake.

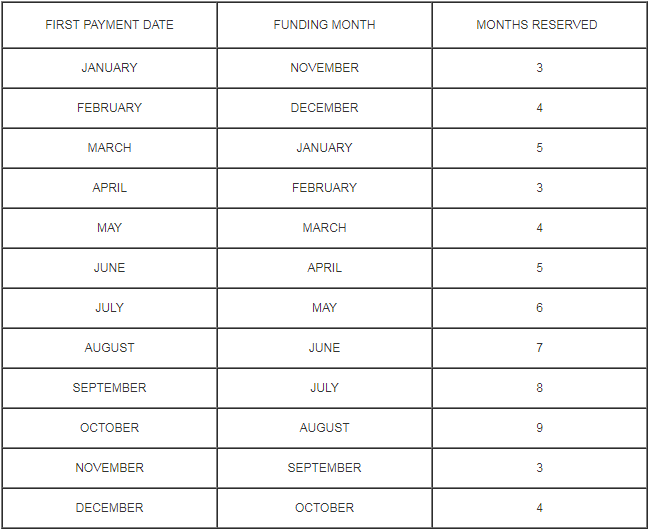

The first payment that you put into the account is called a seed payment or impound deposit and is paid up-front when you take out your mortgage. Your seed payment will give you a two-month cushion on your annual fees. For the seed payment, the Real Estate Settlement Procedures Act (RESPA) requires you to pay two to eight months’ worth of property tax and insurance payments. Whether you need to do two or eight months can be determined by the time of year you fund your loan, as explained by the chart below. Basically, it shows that closing your loan closer to your first semi-annual property tax payment will require you to pay a larger seed deposit.

Escrow/Impound Account Chart

After the seed payment is made to guarantee that the tax and insurance payments can be made in the future, you will begin to make additional, smaller payments into the account. Your lender determines the price of these monthly payments by dividing the annual payment by twelve and evenly adding those twelve amounts to your monthly mortgage payments.

Based on the state you’re purchasing in, the requirements for escrow may vary. One benefit for California borrowers, though minimal, is that lenders are required to pay them the interest accrued on the impound fees. If for some reason, a borrower has insufficient funds in their account, they will not be able to collect any interest that their account earns.

Is an Escrow Account Required?

The short answer is, it depends. Some states prohibit lenders from requiring mortgage escrow accounts when borrowers meet certain requirements, or they require lenders to close the account when the loan-to-value ratio reaches a certain point.

For California loans, your lender will require you to open an escrow account if your loan-to-value (LTV) is greater than 90% or if the loan is insured by FHA (Federal Housing Administration) or the VA (Veteran’s Administration). LTV is the relationship between loan balance and property value.

The reason for this is that borrowers who make a down payment of 10% or less are considered “high risk” because of their lower financial stake in the property. These accounts are there to protect the lender’s investment as well as secure your home as your own. You can still choose to create an account if your lender does not require you to. Paying your insurance fees and property taxes every month tends to be much less of a shock to your finances than paying it in one lump sum, plus the two-month cushion is very useful in the event of not being able to fulfill your mortgage payments or if you have difficulty budgeting these expenses for yourself.

Can Escrow Fees Change?

Property taxes and insurance rates are prone to change, which can cause problems for those who aren’t careful because any tax or insurance payments that are not covered by the escrow account are the responsibility of the borrower. Only in a matter of scenarios is avoiding mortgage insurance possible, something you can bring up to your lender to your overall monthly payment. Your lender is required to include the account balance on your monthly mortgage statement. They will also give you an annual statement when they do their review of your account to make sure that there are not any disparities between your payment and your charge, as required by law.

If you are paying too little or too much, your monthly mortgage payment will be adjusted accordingly. It’s important to keep an eye on your escrow account, your property tax rates (especially around the first of November and February, when your tax payments are made), and your insurance premium for any adjustments.

Can I Cancel an Escrow Account?

Canceling your escrow account can be arduous, as most lenders will charge you a ¼ point (equal to 0.25% of your mortgage amount) to do so. If your home equity has not yet reached 20% by the time you wish to cancel your escrow account, some lenders will not allow you to close the account.

This among other common mortgage mistakes should be avoided during the home-buying process.

Main Takeaway

An escrow account takes the hassle out of budgeting and organizing payments for the borrower while protecting the lender’s investment. While opening one is not always everybody’s first choice, it is a crucial part of the loan process for many borrowers. Be wise with your account and don’t let it out of your sight for too long or you may find yourself with a surprise bill. We recommend researching a great mortgage lender before starting the home-buying process. That way, you’re able to check with them if there is something you have a question about any unfamiliar terms, processes, or if there is a change.